IIPF Peggy and Richard Musgrave Prize

|

| Richard Musgrave (*1910 †2007) on his 90th birthday |

The IIPF created the "Peggy and Richard Musgrave Prize" in 2003 to honor and encourage younger scholars whose work meets the high standards of scientific quality, creativity and relevance that has been a mark of the Musgraves’ contribution to public finance.

It is awarded annually, on the advice of the Scientific Chair of the respective congress and further members of the award committee, to the author(s) of the best paper presented at the IIPF Annual Congress. Authors need to be under 40 years old. In the case of co-authored papers all authors need to be under 40. Age is measured as of the ending day of the Congress, when the prize is awarded.

Authors who wish to be considered for the "IIPF Peggy and Richard Musgrave Prize" should indicate this when submitting their papers for presentation at the Annual Congress.

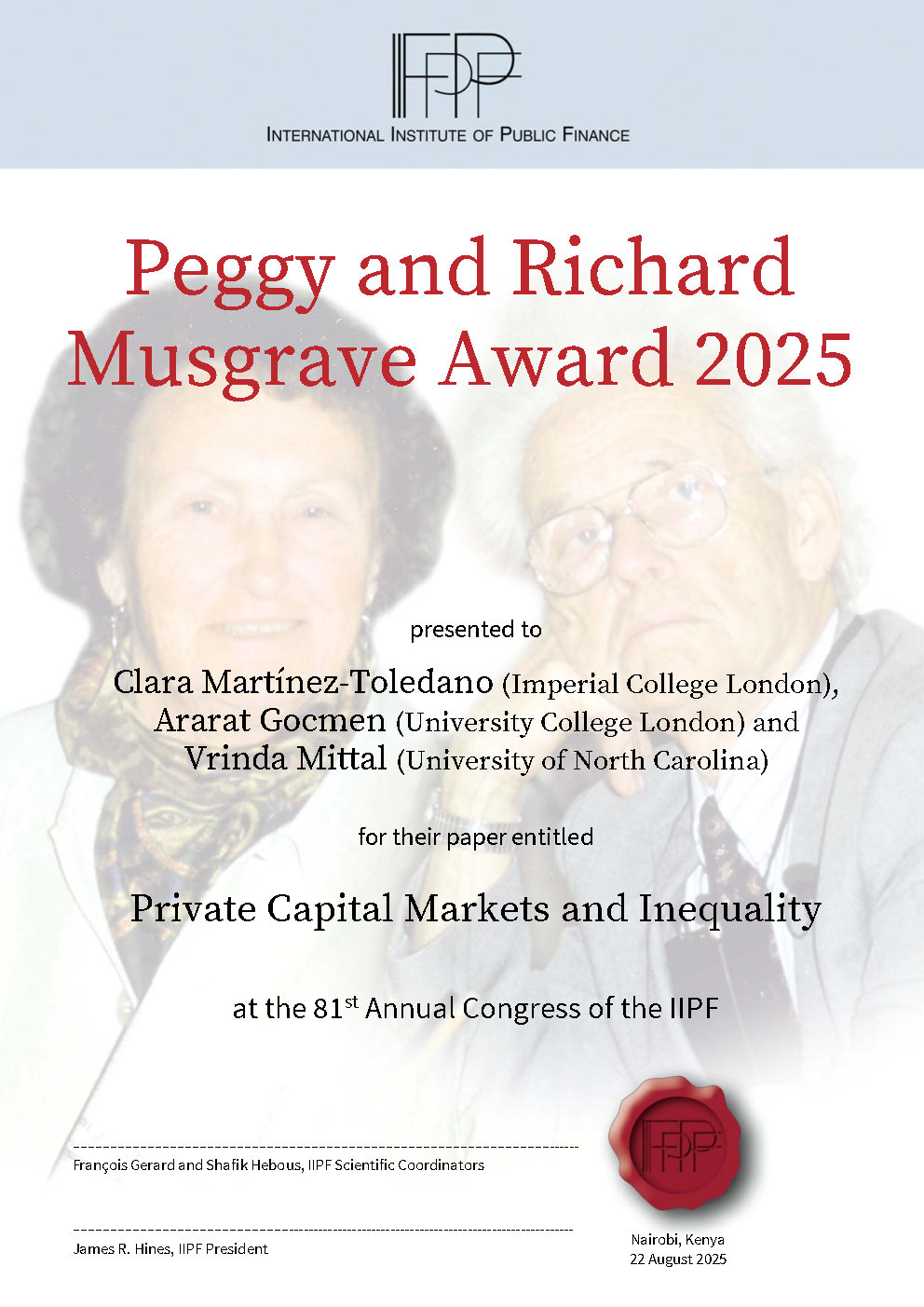

The 2025 IIPF Peggy and Richard Musgrave Prize has been awarded to

Clara Martínez-Toledano (Imperial College London), Ararat Gocmen (University College London) and Vrinda Mittal (University of North Carolina) |

|

Previous Peggy and Richard Musgrave Prize Laureates

| Year | Author(s) | Title of Paper |

|---|---|---|

| 2024 | David Leite | The Firm as Tax Shelter: Micro Evidence and Aggregate Implications of Consumption Through the Firm. |

| 2023 | Augustin Bergeron, Elie Kabue Ngindu, Gabriel Tourek and Jonathan Weigel | Informal Elites as Local Bureaucrats: How Working as a Tax Collector Improves the Performance of City Chiefs in the D.R. Congo. |

| 2022 | Carla Moreno | The Impact Of Pension Systems In Labor Markets With Informality |

| 2021 | Daniel Garrett, Eric Ohrn and Juan Carlos Suarez Serrato | Effects of International Tax Provision on Domestic Labor Markets |

| 2020 | Josef Sigurdsson | Labor Supply Responses and Adjustment Frictions: A Tax-Free Year in Iceland |

| 2019 | Jonas Löbbing | Redistributive Income Taxation with Directed Technical Change |

| 2018 | Olle Folke and Johanna Rickne | All the Single Ladies: Job Promotions and the Durability of Marriage |

| 2017 | Tuomas Kosonen and Tuomas Matikka | Discrete earnings and optimization errors: Evidence from student's responses to local tax incentives |

| 2016 | Alisa Tazhitdinova | Adjust me if I can't: The Effect of Firm Incentives on Labor Supply Responses to Taxes |

| 2015 | Joana Naritomi | Consumers as tax auditors |

| 2014 | Christoph Basten, Maximilian von Ehrlich and Andrea Lassmann | Income Taxes and the Costs of Housing in the Presence of Sorting |

| 2013 | Andreas Bernecker | Divided We Reform? Evidence from US Welfare Policies |

| 2012 | David Albouy | Evaluating the Efficiency and Equity of Federal Fiscal Equalization |

| 2011 | David R. Agrawal | The Tax Gradient: Do Local Sales Taxes Reduce Tax Differentials at State Borders? |

| 2010 | Niels Johannesen | Tax Evasion and Swiss Bank Deposits |

| 2009 | Christian Leßmann and Gunther Markwardt | Aid, Growth and Devolution |

| 2008 | Mikael Elinder, Henrik Jordahl & Panu Poutvaara | Selfish and Prospective: Theory and Evidence of Pocketbook Voting |

| 2007 | Ruud A. de Mooij & Gaëtan Nicodème | Corporate Tax Policy and Incorporation in the EU |

| 2006 | Johannes Rincke | Yardstick Competition and Public Sector Innovation |

| 2005 | Arnaud Dellis | Blame-Game Politics in a Coalition Government |

| Michael Evers | Federal Fiscal Transfers in Monetary Unions: NOEM Approach | |

| 2004 | Matz Dahlberg and Karin Edmark | Is There a "Race-to-the-Bottom" in the Setting of Welfare Benefit Levels? Evidence from a Policy Intervention |

| 2003 | Wojciech Kopczuk | Tax Bases, Tax Rates and the Elasticity of Reported Income |